Tell us: Do you agree with Wu’s proposed tax hike on commercial buildings?

Mayor Michelle Wu proposed temporarily shifting more of the property tax levy onto owners of commercial and industrial properties to protect residential taxpayers.

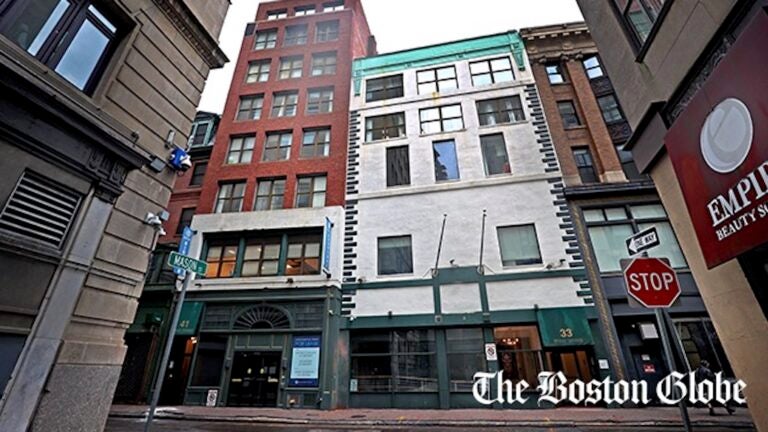

In a home rule petition filed to the Boston City Council on Monday, Mayor Michelle Wu proposed temporarily shifting more of the property tax levy onto owners of commercial and industrial properties. This move is intended to protect residential taxpayers from any hikes in their property taxes caused by declining commercial property values.

“Without legislative action, the result of a trend of declining commercial property values is an automatic jump in residential tax rates in order to fully fund City services,” Wu wrote in the petition.

“Boston’s housing crisis means that residents are already struggling to afford to stay in our neighborhoods, and we cannot increase the burden on homeowners and renters due to an automatic shift caused by the short-term challenges in certain parts of the commercial office sector,” the mayor added.

Despite taking action to revitalize the city’s downtown, in part by converting office space to housing, Boston could still face a massive revenue shortfall in the near future. A study by Tufts University’s Center for State Policy Analysis for the Boston Policy Institute estimates that the city could face a cumulative revenue shortfall of more than $1 billion over the next five years due to the ongoing decline in office values.

If commercial building values continue to fall, homeowners could face higher taxes in order to fully fund city services, rather than an overall revenue decline, Wu’s office said in a statement. The vast majority (72%) of the city’s $4.3 billion budget is funded by property taxes.

The proposal is optional, revenue-neutral, and time-limited. Wu’s proposal would gradually step down over four years before returning back to the current classification system. The mayor said the objective is that future bills for both residential and commercial property taxpayers are as comparable as possible to those from recent years.

“In other words, owners of commercial properties with significant value loss will still see their tax bills decrease, while we cushion any shock for residential taxpayers,” Wu wrote in the petition.

The home rule petition will need to be approved before being signed by the mayor and then sent to the Massachusetts Legislature and the Governor for approval. Boston City Councilors are set to discuss the petition in a meeting on Wednesday.

Do you agree with the mayor’s proposal to increase commercial tax rates in order to protect residential taxpayers from potential hikes?

Tell us by filling out the form or e-mailing us at [email protected], and your response may appear in a future Boston.com article.

Sorry. This form is no longer available.

Be civil. Be kind.

Read our full community guidelines.