China’s economy is slowing, its population aging. That could make it dangerous

China’s economy is in trouble. The juggernaut that once looked bound for global domination is slowing down — and not only in the short run.

The Chinese economy’s projected growth this year has slowed to about 3%, missing the government’s target of 5.5% by an embarrassingly wide margin.

After decades of galloping expansion, that would be the second-worst performance in more than 40 years. Only 2020, with its COVID-induced recession, was worse.

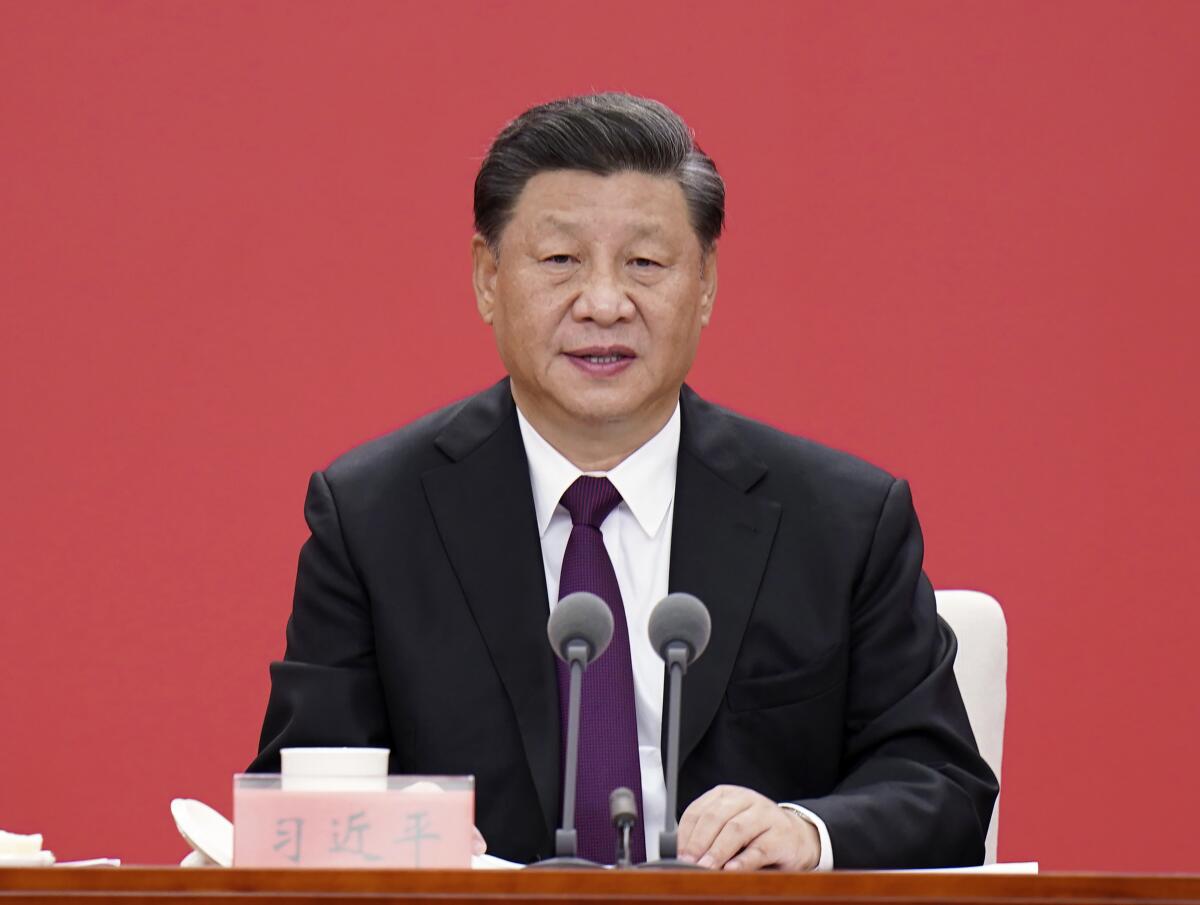

Unemployment among young workers has ballooned to 20%. Fuel prices are rising thanks to Russia’s war in Ukraine. The overbuilt housing industry is teetering. And President Xi Jinping’s draconian “COVID Zero” lockdowns have created havoc, most recently in technology-heavy Chengdu (population 21 million).

Political attention focuses on each party’s base, but the improvement in Democrats’ fortunes this summer offers a reminder: Angering the middle is a good way to lose elections.

Remember when Americans fretted about China overtaking the United States to claim the title of world’s largest economy? That date has been postponed to 2033 or later, and a few economists suggest it might not happen at all.

Some of those problems may be short term, driven by a slowing global economy and Xi’s refusal to import foreign COVID vaccines.

But China also faces long-term challenges that won’t go away, beginning with an onrushing demographic decline.

The United Nations projects that China’s population will shrink roughly 40% by the end of the century, from 1.4 billion to a mere 800 million or so. Some demographers say the decline will be steeper; either way, India will soon take over as No. 1.

The population decline stems from a low birthrate, which also means China’s population is aging and its workforce shrinking. By 2050, more than a quarter of the population will be older than 65, Australia’s Lowy Institute projects. Lowy expects China’s growth rate to slow to an average of less than 3% over the next three decades as a result.

China-watchers agree on those doleful forecasts. They disagree, though, on what that means for the country’s future and for U.S. policy. How does a rising superpower react when the foundations of its strength appear to be eroding?

Two foreign policy scholars, Hal Brands of Johns Hopkins and Michael Beckley of Tufts, have offered a frightening thesis: China’s leaders know their power is about to diminish, and that will make them more likely to take risks in the short run — to invade Taiwan, for example.

China “is losing confidence that time is on its side,” they write in a recent book, “Danger Zone: The Coming Conflict With China.”

“China will have strong incentives to use force against its neighbors … even at risk of war with the United States,” they warn. The “moment of maximum danger,” they suggest, is this decade: the 2020s.

A chorus of other China scholars have disagreed.

First, they note, there’s no evidence that Xi or other leaders believe their power is declining; they continue to predict the rise of China and the decline of the West.

Even if China’s economy slows down, it will be growing — still the second-largest in the world.

“Countries can muddle along with a great deal of poor economic performance and still be a major force in international politics,” noted Aaron L. Friedberg of Princeton, author of “Getting China Wrong.”

Besides, Xi and other Chinese leaders have a strategy for solving their economic challenge, he argued. “They see advances in technology as the key to solving all their problems,” he told me. “That’s how they plan to achieve higher productivity and reasonably high economic growth.”

“We have to do more … to slow down China’s technological development,” he said, beginning with tighter controls on the export to Beijing of U.S. and other Western technology.

A rosier scenario, Friedberg and others noted, is that a slowing economy could induce China’s leaders to devote less spending to military strength and more to improving the lives of the Chinese people.

“We should not assume that a weaker China would be aggressive,” Bonnie S. Glaser of the German Marshall Fund argued. “China could turn inward. Maybe China isn’t as intent on unification with Taiwan as it is on internal stability.”

So the 21st century may not be Chinese after all. China’s rise to global power is neither inevitable nor foreordained.

But even an aging China with a slow-growing economy will be a powerful commercial, technological and military competitor. At least until the end of Xi’s third term in 2027, its leaders will still be ambitious, still bent on absorbing Taiwan, still intent on supplanting the United States as the dominant power in Asia.

China’s challenge is changing its shape, but it isn’t going away.

More to Read

Get the L.A. Times Politics newsletter

Deeply reported insights into legislation, politics and policy from Sacramento, Washington and beyond. In your inbox three times per week.

You may occasionally receive promotional content from the Los Angeles Times.