Readers disagree with Wu’s proposal to bump commercial property taxes

“Commercial buildings need tax relief, not a tax increase.”

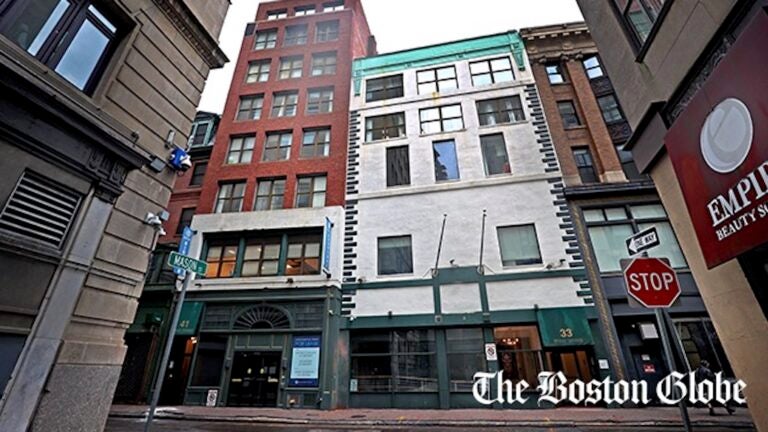

Boston Mayor Michelle Wu filed a home rule petition to the Boston City Council earlier this month proposing a temporary bump to commercial property taxes, which she said is aimed at protecting resident taxpayers from footing a higher tax bill caused by declining commercial property values.

“Without legislative action, the result of a trend of declining commercial property values is an automatic jump in residential tax rates in order to fully fund City services,” Wu wrote in the petition. The vast majority (72%) of the city’s $4.3 billion budget is funded by property taxes.

But Boston.com readers said they aren’t on board with the proposal. When we asked our readers if they agreed with the proposal, a whopping 80% of the 130 respondents voted in the negative, with 18% in the affirmative.

Nor are several City Council members convinced of the proposal. In a Government Operations Committee hearing on Tuesday, city councilors discussed the petition and questioned the effectiveness of the proposed tax hike for commercial properties.

During the hearing, several councilors seemed skeptical of the petition, according to Politico’s Massachusetts Playbook, with District 2 Councilor Ed Flynn voicing opposition to any measure that would raise commercial property taxes. But Ashley Groffenberger, the city’s chief financial officer, asserted that the proposal could protect commercial and residential property owners alike from a surprise hike in their taxes.

Many Boston.com readers expressed fears that if commercial property taxes were raised, it would push businesses further out of a downtown still struggling with high office vacancy rates post-pandemic.

Below, see a sampling of readers’ thoughts — and suggestions — on Wu’s proposal.

Responses have been lightly edited for grammar and clarity.

Do you agree with Mayor Michelle Wu’s proposal?

“While the mayor’s proposal to increase commercial tax rates in order to protect residential taxpayers from potential hikes sounds good on the surface, it seems like a double edged sword. If commercial tax rates increase, this will shield residential property [owners] from seeing their tax rates increase, but businesses will probably raise the prices of their goods and services to offset the increased property tax that they will face. Even worse, some commercial offices may choose to shut down or move out of Boston which would add to the city’s monetary woes. Although the ultimate objective of Mayor Wu’s proposal is to keep future tax bills as comparable as possible to today, it’s very difficult to predict with much certainty how the economy will evolve over the next several years and what adjustments to taxes will need to be made along the way.” – Jeff, Natick

“It will drive commercial out of Boston, property values will decrease as it becomes less desirable of a place to live.” – JT K., South Boston

“Such a move will only further depress the value of that real estate and possibly continue to convert downtown Boston into a ghost town.” – Bill, Boston

“The city should look to cut spending rather than maintain arbitrary spending levels. This sort of chicanery only serves to disincentivize growth and investment by private business into our city, and pushing higher tax bills onto homeowners (for services we often do not receive) feels onerous. Balance the budget appropriately.” – Y.A., Charlestown

“What’s going to happen by taxing buildings in Boston? When you have an open office occupancy rate of 10 – 20% you are only adding costs that will only drive people away. Every time new taxes are applied the cost of ownership goes up and businesses have to charge higher rates.” – L.W., Falmouth

“Strongly doubt this will be temporary. While I understand the need for revenue in a city like Boston, I wonder how much effort there was to reduce costs?” – C.F.V., Cape Cod

“Commercial buildings need tax relief, not a tax increase. The situation should be resolved by other means.” – Mark B., Millis

Boston.com occasionally interacts with readers by conducting informal polls and surveys. These results should be read as an unscientific gauge of readers’ opinion.

Be civil. Be kind.

Read our full community guidelines.