Bitcoin Finds Support at Key Level After Massive Long Liquidations

After a sharp market sell-off caused a flurry of long liquidations over the past 24 hours, both bitcoin (BTC) and several other major cryptoassets found support Thursday morning as the number one cryptocurrency bounced off a key level in the chart.

As of press time on Thursday (08:00 UTC), bitcoin is trading at USD 8,840, down 3.75% over the past 24 hours. Meanwhile, ethereum (ETH) and XRP are down by 3.44% and 1.8%, respectively. As a result of bitcoin falling more than many altcoins, the most recent sell-off partly reversed yesterday’sincrease in bitcoin’s dominance of the total crypto market (currently at 63.39%).

After initially taking a hit that brought the price all the way down to the USD 8,500 level, bitcoin recovered in the early hours of Thursday trading as the price appeared to find support around the key 200-day moving average (DMA) line.

In a similar fashion as bitcoin, litecoin (LTC) also bounced off the 200 DMA early on Thursday, while ethereum reversed higher before even reaching that level.

The 200 DMA is often used by longer-term traders to differentiate between bull and bear markets in stocks and crypto. Any close of a daily price candle below that line would therefore likely be taken as a bearish sign among traders, possibly leading to even more selling.

“We are currently seeing a correction underway from a top reached around USD 10,500 a few weeks back,” Vijay Ayyar, Singapore-based head of business development at crypto exchange Luno, told Bloomberg. “Bitcoin’s safe-haven status is arguably not yet very well established. We’re looking at an overall bearish environment given coronavirus fears and Bitcoin was bound for a pullback anyway.”

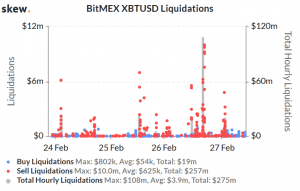

The intense selling that occurred over the past 24 hours also led to a flurry of liquidations on crypto derivatives platform BitMEX, as highly leveraged traders were forced to sell their bitcoin positions to maintain margin requirements.

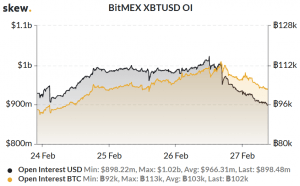

As would be expected, the massive liquidations have also led to a noticeable decrease in the so-called open interest (OI) on BitMEX, meaning the number of futures contracts that are traded either long or short.

For the time being, key levels to watch out for in the bitcoin chart is the 200 DMA at around USD 8,775, the 100 DMA at USD 8,284, and the 50 DMA (which was breached yesterday) at USD 9,233.