86% Of Surveyed Central Banks Now Engage In CBDC Work – BIS

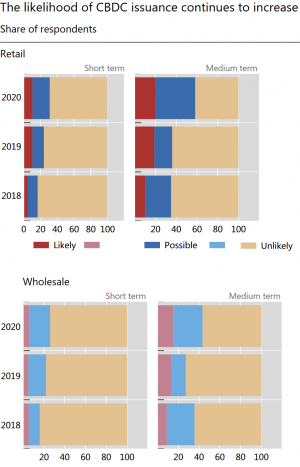

As the world’s central banks are increasingly looking into central bank digital currency (CBDC) projects, their focus is shifting into more advanced stages of CBDC engagement, with more banks moving from conceptual work to experimentation, according to a new report by the Bank for International Settlements (BIS).

Data presented by the report, entitled Ready, steady, go? – Results of the third BIS survey on central bank digital currency, shows that, over the last four years, the share of central banks that actively engaged in CBDC work rose by about one third to a total of 86%. The central banks that are not involved in CBDC primarily hail from smaller jurisdictions, and more banks are either looking at both wholesale and retail, or narrowing their activities to only retail, according to the BIS.

“Central banks are moving into more advanced stages of CBDC engagement, progressing from conceptual research to experimentation. About 60% of central banks (up from 42% in 2019) are conducting experiments or proofs-of-concept, while 14% are moving forward to development and pilot arrangements,” the report said.

The BIS added that last year was important for the CBDCs’ roll-out, as it “marked the arrival of a ‘live’ general purpose CBDC when the Bahamas launched its Sand Dollar for its residents on 20 October 2020.”

Figures from the report were collected from 65 central banks that replied to the survey in 2020. Respondents account for close to 72% of the global population, and 91% of the world’s economic output, according to the bank. The surveyed countries included both advanced economies (AEs) and emerging market and developing economies (EMDEs).

Analyzing how CBDC projects might vary on a regional basis, the BIS observes that “[p]ayment-related motivations, such as domestic payments efficiency and payments safety remain at the heart of both AEs and EMDEs’ motivations for issuing general purpose CBDCs.”

This said, “EMDEs report stronger motivations for issuing CBDC than AEs,” according to the report.

Financial inclusion is considered to be the main factor driving CBDC projects in the emerging and developing economies. However, the survey also shows that other factors, such as financial stability and monetary policy, have become over time more persuading motivations for CBDC work in those countries.

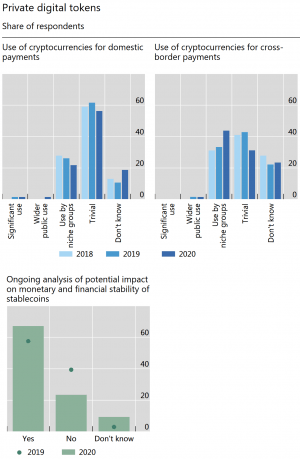

Based on the collected answers, the report concluded that regarding “cryptocurrencies, central banks continue to see these as niche products with no widespread use as a means of payment,” but, at the same time, “developments in stablecoins are closely watched given their potential for rapid adoption by consumers.”

Established in 1930, the BIS says it is jointly owned by the world’s 62 central banks, representing countries that together account for some 95% of the global gross domestic product (GDP). The bank’s head office is located in Basel, Switzerland.

___

Learn more:

COVID-19 Pandemic Accelerated Rollouts Of ‘Game-Changing’ CBDCs

Expert Warns CBDCs Won’t Carry the Same Advantages as Bitcoin

2021 Trends in CBDCs: More Pilots, Maybe Some Launches, But Not For Retail

How CBDCs Might Change Our Daily Payments

Japan Heading for Stage Two of its CBDC Pilot in Spring

Mexico May Be Forced to Issue Digital Peso, Claims Economist

Fed Chief Bets That US’s ‘First-Mover Advantage’ in CBDC Race Is Stronger Than China’s

Legally Speaking, is Digital Money Really Money?

Europeans Warn ECB Not To Mess With Privacy in Digital Euro

Further Details of ‘Offline’ Chinese Digital Yuan ‘Hard Wallet’ Emerge