Why is it vital for telecom operators to think about O-RAN in current scenario?

Nokia believes that operators will go for virtualised RAN in initial phase and Open RAN when it reaches maturity

Open Radio Access Network or O-RAN as a concept has been there for some time, but it’s getting traction in recent times.

The current financial, geopolitical and pandemic global environment has illustrated the importance of it in the current scenario.

Geopolitical concerns are restricting the number of vendors able to deploy 4G and 5G networks in certain countries while the vendor lock-in is restricting innovation and does not allow more favourable horizontal market conditions.

Currently, the RAN market is dominated by Nokia, Ericsson and Huawei and uses proprietary software and hardware components tightly coupled to create a vendor lock-in for telcos.

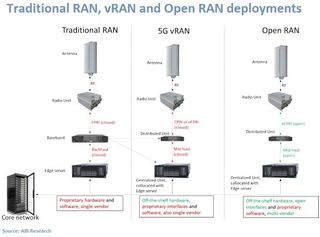

RAN is just the radio access part of the network, i.e. the base stations (antennas, radio and basebands) plus associated controllers and some other peripheral equipment. Then there is the transport network and the core which are two different subsystems of a mobile network.

O-RAN promises to be an alternative way of building networks with greater interoperability by allowing different companies to supply different parts of the network and facilitate network deployments at a massive scale.

Aji Ed, Chief Technology Officer at Nokia Middle East and Africa, told TechRadar Pro Middle East that two separate forums were created to define the technical specifications for Open RAN - O-RAN Alliance and Telecom Infra Project (TIP), a Facebook-led association promoting open network technologies.

Are you a pro? Subscribe to our newsletter

Sign up to the TechRadar Pro newsletter to get all the top news, opinion, features and guidance your business needs to succeed!

Earlier, there was a forum called xRAN but it has become obsolete.

The Telecom Infra Project (TIP), meanwhile, describes itself as an engineering-focused, collaborative methodology for building and deploying global telecom network infrastructure to enable global access for all.

TIP’s working groups cover topics including the Open RAN ecosystem, mmWave low-cost hardware, power and connectivity and optical transport.

The O-RAN Alliance focuses on defining a set of open interfaces between the different building blocks of the RAN architecture and defines a new element, the ‘RAN Intelligent Controller (RIC)’, which enables the creation of applications (known as xApps) to optimise processes or launch new services.

The O-RAN Alliance is a global community with over 160 companies (including 24 mobile operators across four continents) and governed by a global board spanning four continents and 11 countries (4 from Europe, 2 from China, 2 from India, 2 from Korea, 2 from the US, and one each from Australia, Japan, and Singapore).

Vendor diversity and innovation

O-RAN alliance defines a set of interfaces which are, in turn, aligned with the standards of 3rd Generation Partnership Project (3GPP), standardisation body in charge of cellular technologies.

Moreover, smaller vendors and innovators face big hurdles to enter into the 3GPP and other standard discussions, and the locked-in industry inhibits their ability to successfully commercialise their innovative products.

Nokia was the first major vendor to join the O-RAN Alliance and it is co-chairing the workgroup that is defining the open front-haul interface and the near real-time RIC which will help automate and optimise the network.

Critics say that both Ericsson and Huawei are worried about ceding market shares to O-RAN suppliers.

Ericsson, ZTE, China Mobile and China Telecom are part of the O-RAN Alliance but Huawei, which is an active member of GSMA and 3GPP, is not a member of the O-RAN Alliance.

Also, there are many lesser-known Chinese companies such as Genentech, Inspur, Sunwave and Tongyu involved in the O-RAN Alliance.

Ericsson’s name is not mentioned in the launch of the Open RAN Policy Coalition and critics say that Huawei may not be keen to join the policy coalition dominated by the US.

When asked Ericsson about the O-RAN, they declined the invitation to comment.

However, critics say that Ericsson is very likely to join at a later stage when O-RAN gains traction or it will lose market share.

Gareth Owen, Associate Director at Counterpoint Research, said that O-RAN provides diversity and enables new entrants to come into the market and supply "parts" of the RAN without having to provide complete end-to-end solutions.

The advantages, he said are linked to vendor diversity and leads to more innovation and more competition, thus lowering the prices for operators.

“The O-RAN is opening up the interfaces on the horizontal level of the radio, whereas the cloud-RAN (vRAN) is opening up the radio at a vertical level. Once the O-RAN interfaces are matured, this Cloud-RAN architecture can be migrated to O-RAN,” Ed said.

Mideast could see vRAN deployments next year

The vertical level in vRAN, which implies the virtualisation of the DU (Distributed unit) and CU (Centralised unit), means splitting the hardware and software separately and it can be delivered by multiple vendors.

In the O-RAN, the horizontal level means the radio unit provided by one vendor and baseband provided by another vendor.

Ed said that vRAN is being implemented by Verizon in the US (mmWave spectrum) and have virtualised the baseband.

Next year, he said that the industry could see the virtualisation in the Middle East region (C band) and the telecom operators are thinking about vRAN and O-RAN.

“Telecom operators recognise the challenges they foresee with this architecture in the near term. However, they also see that something is needed for the future, in terms of flexibility. Most probably, they will go for the vRAN in the initial phase and O-RAN when it matures,” he said.

UAE-based telecom operator Etisalat, in partnership with Alitostar, NEC, Cisco and others, has successfully launched the vRAN network in the Middle East and Africa in January this year and has tied up with Parallel Networks in February for O-RAN trials in the region.

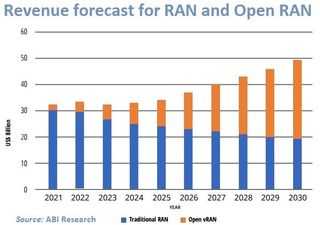

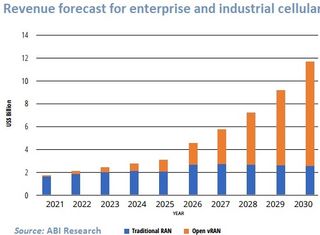

ABI Research expects the ORAN market to reach a total market of $30 billion in 2030, climbing higher than the traditional RAN market, which will be a total of $20 billion.

The transition is not expected to happen overnight for public cellular networks that connect consumers to the network but will be vital, where ABI Research expects Open RAN to drive a $10 billion Greenfield market.

ABI Research projects that the inflexion point between traditional radios and Open RAN will happen during 2028, after which open interfaces and open network deployments will overtake proprietary vendor products.

“Maturity of the O-RAN interfaces and the ecosystem is likely to take a few years and the O-RAN implementation is expected to happen in phases. In the initial phases, the network architecture can be built with Cloud-RAN (virtualised RAN) architecture. Both O-RAN and cloud-RAN are disaggregating the RAN,” Ed said.

“We will continue to actively work on these groups to develop the specifications further. Nokia envisages supporting O-RAN interfaces and vRAN. Nokia’s O-RAN interfaces will be built on top of its existing AirScale software, providing the same high performance and feature set our customers expect.

“We support all the three types – classical 5G, vRAN and O-RAN architectures. O-RAN is likely to take a couple of years to reach maturity and will primarily be focused on 5G. 5G deployments can continue with classical or virtualised RAN architectures now,” he said.

Interoperability and integration issues

In the short term, Owen said the best opportunities are likely to be in-building and private networks, particularly after 5G NR hardware becomes available later this year.

However, he said that new opportunities will emerge as 5G matures and MNOs start thinking about upgrades and enhancements to their networks.

“Nokia, Samsung and Ericsson have already announced they will offer open RAN. Nokia and Samsung already have some deployments although strictly speaking the "open" interfaces are not O-RAN Alliance compliant yet and do not include the all-important front-haul interface between the radio unit and the baseband,” he said.

It is not easy to convert existing kit and many operators will not even try it, he said and added that they will probably adopt open RAN when they come to do their next network upgrades.

“O-RAN can be used for new 4G and 5G networks and it is an upcoming technology that will probably be widely deployed along with vRAN in future years. However, at this stage, it is an immature technology lagging mainstream 5G technologies so it will take several years before it will be able to compete on all levels,” he said.

However, he said that there is a risk that the incumbents will lose market share if they adopt O-RAN interfaces, particular in the case of the radios.

He believes that they will play a key role in O-RAN deployment and could be well-positioned to defend their market share, particularly in the short-term.

Moreover, he said that there are many disadvantages such as the fact that there are many players involved which brings up problems with equipment interoperability and integration.

“There is no single vendor to which an MNO can turn to when problems arise, although this could be solved with a very competent systems integrator. However, this all adds extra costs which could eliminate initial equipment costs savings.

“Security is more of an issue because there are many more players and different bits of kit involved. A single-player such as Nokia can more easily guarantee security across a complete end-to-end network (including the transport network and core),” Owen said.

Advantages

- Avoid vendor lock-in for the operator and give the possibility to select the best vendor per component.

- Supply chain flexibility.

- Allows complementing one vendor portfolio when one element is missing e.g. a specific RF variant.

- Can foster innovation by having specific input from third party e.g. a specific RF unit.

- Prices could go down per module.

- Overall, the promise of virtualisation is end-to-end orchestration and automation, which saves Opex.

Challenges

- Multi-vendor requires additional work on feature alignment, interoperability, integration and these have to be performed for every release. This impacts the time to market and the TCO (total cost of ownership) negatively.

- Interoperability at the functional level does not guarantee that same performance as single-vendor cases, since the interactions between algorithms between different vendors can be sub-optimal or even may lead to performance issues.

- The multiplicity of network management systems can also lead to higher operations costs.

- A disaggregated solution may have more security vulnerabilities.

- No single accountability of faults, stability and performance KPIs.

- Risk of actual TCO increase due to “build a car of spare parts” effect. Decomposition costs are more because you have to do integration, align vendors etc. someone has to pay.

- Slows down innovation for features spanning multiple units due to the need to align with multiple vendors.

Most Popular