Chainlink Rallies as New Partnerships Announced, DeFi Market Soars

After a month of heavy selling, Chainlink’s LINK token found some relief today, supported by increased bullish sentiment in the DeFi space and the announcement of several new partnerships.

At the time of writing, (08:42 UTC), LINK was up by 15% over the past 24 hours, trading at USD 9.68. However, the price still was down nearly 11% for the week, and 32% for the month, after a large sell-off earlier in September.

LINK price chart:

The gains for LINK today came as the crypto-friendly travel booking site Travala.com earlier this week announced a new partnership with Chainlink. According to the announcement, LINK will be integrated as a payment option on the booking site, enabling LINK holders to pay for accommodation at over 2.2 million hotels and homes.

Meanwhile, Chainlink, announced yesterday that a non-fungible token (NFT) project known as Aavegotchi (GHST) will “make full use” of the oracle platform’s Verifiable Random Function (VRF) as it moves ahead in the recently popular sector.

Chainlink’s VRF is a new feature released in May this year intended to “generate randomness that is verifiable on-chain.”

Further, LINK may also have received some support from the broader market today, with the DeFi space, in particular, seeing buying across the board. Over the past 24 hours, nearly all tokens listed in Coinpaprika’s ‘DeFi’ category were in the green, with some seeing gains in the double digits.

In addition to LINK, which is categorized as a DeFi token by some tracking sites and not by others, uniswap (UNI), balancer (BAL), and synthetix (SNX) stood out as the biggest winners in the space today with 24-hour gains of between 11% and 12% each, at the time of writing.

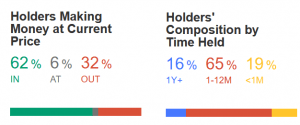

Despite heavy losses earlier in the month for LINK, however, on-chain data from IntoTheBlock still shows that most holders have managed to remain profitable on their investment, with 62% of holders estimated to be “in the money.”

__

Learn more: DeFi Sell-Off Just ‘a Pullback,’ Boom Not Over Yet – Analysts